CSE professor Henrik Christensen, director of the Contextual Robotics Institute at UC San Diego, testified March 16 in front of the U.S.-China Economic and Security Review Commission, a bipartisan group that monitors and investigates the national security implications of the bilateral trade and economic relationship between the United States and China.

Contextual Robotics Institute.

The hearing's theme was "China's pursuit of next frontier tech: computing, robotics and biotechnology" in light of China's 13th Five-Year Plan and state investments in the period from 2016 through 2020. Christensen's testimony was part of a panel on military and industrial robotics, and the invitation to testify on the subject followed his remarks about industrial robots quoted in the New York Times earlier this year (and reported previously in the CSE Newsletter).

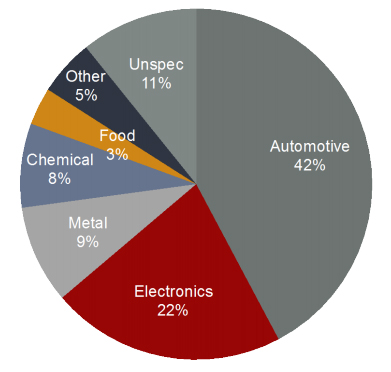

In his testimony, Christensen noted that although the robotics industry was largely invented 55 years ago in the U.S., initially to serve the automotive industry, today most industrial robots are made abroad -- in Japan, China and Germany. Until 2013, the U.S. remained the largest market for industrial robots, but no longer. Today, Chinese demand for industrial robots is roughly two-and-a-half times larger than U.S. sales. Cars remain the biggest single market, but Detroit has long since lost its dominance in the industry: while 6 percent of cars are manufactured in the U.S., 31 percent roll off Chinese assembly lines.

In his testimony, Christensen said that two-thirds of $30.5 billion turnover of the industrial robotics industry worldwide came from direct sales of robot unit, and one-third from systems integration. "The entire industry has a consolidated annual growth rate of 17 percent since 2009," he noted. "The Asia region saw a 41 percent annual growth in 2014-2015 and is by far the fastest-growing region worldwide," far faster than the 9 to 13 percent annual growth in U.S. production.

application domains in 2015. (Source: World Robotics)

In addition to its growing dominance in manufacturing of robots, China also purchases roughly 27 percent of all robots worldwide. That makes it #1 in overall use, although the Republic of Korea remains #1 in the use of robots per capita: more than 500 robots are used per 10,000 workers in Korean factories, i.e., one robot for every 20 workers. Singapore is in second place and Japan in their. By contrast, the U.S. uses 176 robots per 10,000 workers, and China lags far behind at 49 robots per 10,000 workers -- even though in aggregate terms, China is the largest total user of industrial robots.

"Today many robotics companies are investing in China rather than the U.S.," added Christensen, "because that's where the big opportunity is." According to the CSE professor, the largest robotics providers in China are now joint ventures between Chinese and foreign companies, including Japan's FANUC, Sweden's ABB, and Germany's KUKA (which is now in the process of being acquired by China's Midea for $4.5 billion, a deal expected to be finalized this month). "No doubt more acquisitions will happen over the next few years," predicted Christensen.

Christensen's testimony also dealt with a very different picture in airborne robotics, particularly unmanned aerial vehicles (UAVs), where the U.S. companies General Atomics, Northrup Grumman and General Dynamics remain dominant, particularly in the military arena. But the non-military market for UAVs is expanding rapidly too. "The UAV market is about to take off big time for assistance in the logistics space," said Christensen. "The applications are abundant, from infrastructure inspection over environmental monitoring to package delivery... and [Chinese] companies such as Ehang and Yuneec are quickly joining [U.S. companies] to be the leaders in this space."

"No doubt the U.S. is the leader on large-scale UAV technology today," added Christensen. "But given that more than 50 percent of the commercial UAV industry is in China today, this balance could change quickly."

In his concluding statement, the UC San Diego professor turned to the policy implications of China's growing role in industrial and military robotics. "The investment in China is at least $10 billion per year, while the corresponding number in the U.S. is likely around $2 billion per year," said Christensen. "For industrial robots, non-U.S. companies are today more likely to invest in China than in the U.S. as the big growth opportunity is in southeast Asia. The U.S. market is relatively mature, whereas the Chinese market is still emerging."

He noted that Chinese companies are setting up R&D labs in the U.S. "as the movement of the best people to China still poses a challenge due to language and cultural barriers... To compete, it will be essential to continue to promote the U.S. as an innovation economy and the best place to innovate."

Read Henrik Christensen's full testimony to the U.S.-China Economic and Security Review Commission.